The world’s main authority on local weather change, the Intergovernmental Panel on Local weather Change (IPCC), has lengthy warned that until pressing motion is taken, we’re heading in the right direction to expertise irreversible and catastrophic environmental penalties of world warming beneath a variety of believable bodily local weather situations by the tip of this century and past.

Extra lately, central banks and monetary regulators have posited that local weather change – each by way of its bodily impacts in addition to efforts to transition to a greener future – poses a menace to the steadiness of the worldwide monetary system, sparking a race to higher perceive and quantify local weather impacts inside the monetary business. This has led to an increase in using local weather situations inside stress assessments carried out by regulators throughout the globe.

Curiously, the preliminary findings painting a really totally different and benign image when juxtaposed in opposition to IPCC findings, giving rise to the present debate round whether or not local weather situations have been used appropriately and whether or not stress testing is certainly strong and decision-useful.

Acknowledging that this space is an rising self-discipline, it’s instructive that the null speculation of widespread monetary stress related to future local weather change stays unsupported by the multi-jurisdictional findings thus far.

As such, this text goals to make clear key causes for this disconnect by first contextualising the applying of local weather situations inside stress assessments earlier than highlighting methodological challenges within the growth of bodily and transition danger situations.

Conventional Stress Exams vs Local weather Eventualities

As local weather dangers usually materialise over a far longer interval in comparison with non-climate-induced macroeconomic shocks and contain the introduction of local weather variables which are past the socioeconomic realm, conventional stress testing approaches and frameworks have been tailored to cater for these basic variations.

Earlier than critically assessing the methodology of local weather situations, it is very important respect the best way local weather situations have been used inside stress assessments as this, partially, explains why outcomes haven’t been as extreme as that of conventional non-climate macro-prudential workout routines.

Firstly, a typical conventional, non-climate situation usually options pathways that resemble a monetary disaster. A extreme and long-lasting recession that includes a fall in GDP, unemployment rises in the true financial system and turmoil that ensues inside the monetary markets with spikes in danger premia and sharp share worth declines.

Local weather situations thus far merely don’t produce this degree of severity and as an alternative characteristic clean macroeconomic pathways.

The second vital distinction is the belief of a restoration pathway inside conventional situations. Most financial variables assume a restoration pathway (i.e., GDP/unemployment tends to be V/tent-shaped) following a shock occasion. However this may increasingly not maintain for local weather danger, significantly bodily local weather danger as irreversible tipping factors are crossed.

Relatively than simulate a shock occasion adopted by restoration, local weather situations by design will duly arrive at a brand new regular or baseline, with the deviation from ‘non-climate impacted’ trajectories in addition to stranded belongings (i.e., infrastructure impacted by sea degree rise) handled as climate-related prices.

Lastly, conventional stress testing regimes are likely to have a slender give attention to monetary shock occasions – which can be too restrictive to seize the wide-ranging impacts and unsure loss pathways of local weather danger.

Traditionally, not each recession has essentially brought about or adopted a monetary disaster. It’s because monetary crises are basically triggered by way of the mispricing or repricing of economic belongings, mixed with inadequate capital of main monetary actors equivalent to banks to soak up the shock.

The COVID-19 pandemic, which noticed a a lot bigger drop of GDP in comparison with the 2008 International Monetary Disaster (GFC), is an effective instance of the above distinction. Conversely, an instance of a doubtlessly creating disaster can be the very latest failure of Silicon Valley Financial institution – hardly a systemic monetary establishment by any measure – however but, we’re already beginning to see spillover impacts equivalent to a broader financial institution run on comparable smaller regional banks, potential interruption of central financial institution price coverage, in addition to international trade (FX) impacts.

Whereas there has not been any conclusive proof thus far, bodily local weather danger is arguably extra prone to manifest in systemic injury to the true financial system earlier than ensuing monetary crises – additional mentioned within the following sections.

Transition danger

In 2020, the Community for Greening the Monetary System (NGFS) produced the primary set of local weather situations derived from three totally different built-in evaluation fashions (IAMs): REMIND-MagPie, MESSAGE-GLOBIOM and GCAM.

All of those situations and their respective IAMs are primarily based on the shared socioeconomic pathways 2 (SSP2), which prescribes widespread assumptions on inhabitants, financial growth, institutional energy and technological progress. The publication of those situations proved a problem to situation economists and modellers at monetary establishments on a number of fronts.

As a begin, the variety of variables is a a number of of what conventional stress testing has been utilizing. For any particular area or nation, there are greater than 700 particular variable ideas throughout six situations, three modelling programs and a number of other areas and international locations.

The primary NGFS IAM classic had a complete of greater than 800,000 variable paths. Then once more, out of this huge IAM information set, there have been solely a restricted variety of variables that monetary establishments would have mapped to their conventional set of variables on the time. Past actual GDP and a generic crude oil worth, most variable ideas have been alien to danger managers that have been erstwhile acquainted solely with macro-financial variables.

It is very important level out that the main analysis institutes didn’t think about the macro-financial impression, equivalent to frictions in credit score markets, the dynamics of the yield curve nor the impression on international trade. Their preliminary goal was to estimate future emissions and potential pathways to mitigate local weather change. With a few of these fashions there is no such thing as a discounting, markets clear and brokers have good foresight. None of those assumptions are essentially unsuitable to fulfil their preliminary goal amongst non-financial policy-makers, however the problem lies with its easy extension to the monetary panorama that proves problematic, and the rest of this part will discover a few of these challenges in additional element.

First, local weather transition situations are unable to supply acute monetary shocks by design primarily as a result of key macro-financial variables are too clean and don’t characteristic recessions. That is additional compounded by modelling time steps of five-year increments which are far too temporally coarse to seize sudden occasions, significantly in comparison with conventional stress assessments (within the case of Financial institution of England, quarterly intervals).

Nevertheless, IAMs can nonetheless be useful to tell local weather danger views if consideration is concentrated on different extra particular options fairly than the important thing macroeconomic variable paths or ‘crimson herrings’ for monetary establishments. For instance, a extra liberal interpretation of insights of IAM will result in consideration not merely of losses however future income streams, frightening pertinent questions such because the cessation of funding to the oil/fuel business within the close to future, crowding out the impression of huge funding cycles on specific industries, or applied sciences that have to be phased out.

Subsequent, the situations, partially owing to its inherent complexity and the first person base of stress testers, are sometimes misconstrued to symbolize tail-risk occasions (situations that can happen with a small chance), in addition to being static in nature couched in fastened time frames.

The truth is, the situations have been particularly designed to simulate a variety of believable futures – starting from pathways that obtain web zero on the one hand, or within the case of the so-called ‘scorching home’, miss-stated emission targets.

As such, as an alternative of substituting situations as proxy stress assessments, monetary market contributors ought to apply them as a baselines to benchmark their very own long-term technique, the place stresses may happen inside ANY given situation. The fastened timeframe conundrum refers back to the observe widespread inside conventional stress testing to recycle the identical situation – with minor changes – as a ‘roll ahead’ from the earlier 12 months. That is particularly problematic for transition danger, as a result of pace of transition to totally different applied sciences.

For instance, probably the most radical transitions of expertise entails horse-drawn carriages being substituted by hydrocarbon-fuelled transport equivalent to the interior combustion engine. Nevertheless, it didn’t lead to widespread stranded asset danger because the transition occurred over nearly 100 years. In distinction, IAMs are predicting a transition of fewer than 10 years for a wide-range of industries, which is usually shorter than the funding cycle of most capital items. As such, adopting a ‘roll ahead’ fastened timeframe strategy underestimates the dynamic, quickly rising danger profile of situations. Particularly, the Internet Zero by 2050 shouldn’t be a movable goal and merely seven-years from now can be the beginning of the ‘delayed situation’ which sees far greater carbon pricing and drastic motion required to achieve web zero.

Lastly, one other key motive for artificially gentle situation loss outcomes stems from the truth that IAMs don’t discover a disruptive path throughout applied sciences and power transformation.

In these situations, market contributors completely plan, make investments and worth with simply the correct amount of power generated or adequate demand for biomass. In actuality, and as historical past and behavioural economics have demonstrated time and time once more, that is unrealistic.

It isn’t tough to think about that there could also be durations when there’s inadequate electrical energy to fulfill the calls for of a rising electrical automobile (EV) sector. As well as, the urgency to develop untested clear applied sciences might exacerbate herd-mentality and optimism bias, manifesting within the tunnel imaginative and prescient of traders as has occurred in previous durations of technological disruptions the place traders, collectors and policy-makers collectively did not detect systemic points. Given the speedy pace of innovation, not solely fossil gas however renewables might flip into stranded belongings as right this moment’s newest answer to power storage might change into out of date tomorrow.

Bodily danger

Historic local weather danger and related loss outcomes have usually been provided as a proof or proof to assist non-severe impacts. Nevertheless, what this critically misses is that we’ve not felt the complete brunt of elapsed local weather change (because of time lags), and that the subsequent hundred years of local weather change will look basically totally different to the final hundred years, even beneath extra optimistic situations.

Scientific literature is wealthy in content material exploring regime change and non-linearities within the frequency and severity profile of acute excessive occasions and thresholds/ step adjustments/ chosen tipping factors, compound occasions and feedbacks. This helps the rivalry that historic expertise could also be a poor predictor of future impacts. Moreover, there’s additionally rising inter-connectivity inside the international financial system and hidden provide chain inter-dependencies which were laid naked by COVID.

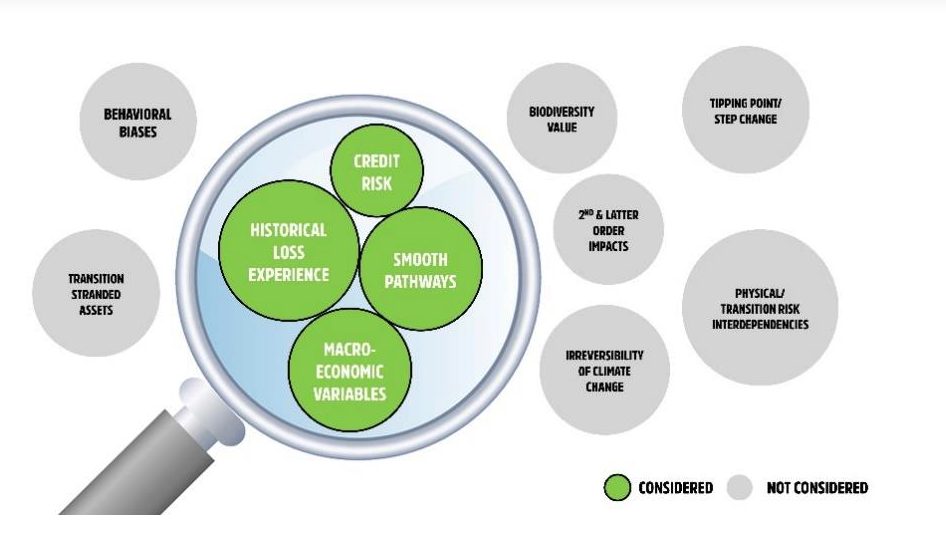

As alluded to earlier within the article, one other problem is the framing of loss outcomes when it comes to credit score, market or liquidity danger that solely considers direct losses suffered by monetary establishments.

In actuality, financial institution’s could also be insulated from bodily local weather danger by a number of buffers, thus an overt give attention to monetary loss outcomes masks the wide-ranging impacts of local weather to the true financial system and society at giant. For instance, the impacts of acute bodily danger to residential mortgage credit score danger are modest (particularly relative to the GFC) , significantly for a big and geographically well-diversified portfolio buffered by basic and lender’s mortgage insurance coverage safety.

Traditionally, even in cases the place insurance coverage is both unaffordable or unavailable, governments have stepped in to offer subsidies by way of danger pool schemes funded finally by way of the tax-payer or the federal government’s potential to boost debt. Thus, focusing completely on credit score loss outcomes dangers being lulled right into a false sense of safety because the collective burden of society is ignored, with banks latently saddled with outsized stranded belongings in a future when bodily local weather danger burden (each because of portfolio progress and local weather change affect on excessive climate occasions) exceeds the insurance coverage sector and authorities’s cushioning capability threshold.

Since inaugural local weather stress assessments world wide have been commissioned, they’ve yielded modest outcomes for bodily danger. Portfolio composition and business combine apart – these stress assessments usually use what has emerged because the de-facto ‘business’ customary for local weather situation evaluation strategies prescribed by NGFS. Ostensibly to allow comparability between totally different monetary actors to tell traders, it signifies that situation views are knowledgeable by a restricted set of methodologies. Within the case of NGFS, the really useful strategy to estimating persistent bodily danger, in addition to the longer term time interval of curiosity, has an impression on the modelled severity of loss outcomes.

Whereas it has been noticed that actual GDP per capita and temperature (i.e., hotter international locations are usually poorer) are correlated, the Kalkuhl and Wenz, 2020 methodology prescribed by NGFS give attention to central tendency by way of using least squares estimates, in addition to being restricted to losses (significantly labour and productiveness) stemming purely from temperature. Importantly, this disregards the impression of sea degree rise and different lesser-known danger elements, equivalent to soil subsidence. There may be arguably an extra ‘dilution’ of potential impression by way of using annual imply temperature and precipitation on a regional foundation.

Moreover, the shortage of consideration of ecosystem companies within the creation of biodiversity decline is notable. A extra strong estimate taking into consideration lowered pollinator effectivity (with agriculture and meals safety penalties), extra carbon launch in wildfires, ocean acidification and warming, and impacts to different vital programs will paint a extra full image of bodily danger impression past the scope of GDP.

Most stress assessments give attention to projecting impacts at 2050 time horizon which misses capturing the essence of nonlinearities documented above. Though a distant timeline possibly tough to reconcile for an business that has been primarily targeted on quick time period efficiency, a 2050 view for bodily danger renders the train restricted in utility and is exactly one of many key explanation why IPCC and different scientific our bodies use end-of-century projections to tell coverage and warn of the devastating impacts of local weather inaction.

No consideration for mixed bodily and transition danger dynamics

Though it’s handy to compartmentalise bodily and transition danger neatly into separate buckets (as is the case with current frameworks), the fact is extremely nuanced with important interdependency between these two broad danger sorts.

Persevering with to deal with bodily and transition dangers as separate inside the broader local weather danger taxonomy results in over-simplified situation outcomes. Ideally, situations shouldn’t create a false trade-off narrative with much less bodily danger in a transition situation. Bodily danger will no less than be as excessive in any transition situation for the subsequent 20 years.

The truth is, a direct hyperlink between bodily and transition danger domains might be present in power demand projections and the efficacy of renewable power targets. For instance, the extreme drought that impacted Europe and China in the course of the northern hemispheric summer time of 2022 led to the drying of hydropower (varied dams throughout Europe or the Yangtze in China). As these drought occasions are projected to worsen sooner or later, it may pressure a re-pivot to fossil fuel-driven power sources thus making a vicious suggestions loop that each ends in failed hydropower investments from missed operational targets, in addition to additional compounding of the general bodily local weather disaster from unplanned emissions.

Equally, earlier pure catastrophes equivalent to typhoons have been identified to adversely impression wind farms and floating photo voltaic in Japan, elevating doubts concerning the scalability and reliability of those options as a viable various to conventional power sources.

A extra refined, however no much less disruptive hyperlink manifests on the whole public attitudes in direction of bodily local weather danger as increasingly individuals start to both expertise local weather catastrophes first hand for the first-time, or are gaining consciousness that it’s occurring to them by way of advances in excessive local weather occasion attribution science.

Analysis already means that residents in Western Europe who’ve endured acute danger occasions, equivalent to warmth waves and floods usually tend to vote for Inexperienced events (see the success of the Inexperienced social gathering within the German Federal Elections after the floods in Western Germany).

Different newer however much less well-researched and documented cases embody Japan’s sudden adoption of the Internet Zero Dedication following a spate of extremely damaging Typhoons that struck main cities of Osaka and Tokyo throughout 2018- 2019 – significantly with the unprecedented rainfall following Storm Hagibis. For a rustic that typically eschews sudden and radical coverage adjustments, that is extremely important as Japan could be very a lot depending on imported fossil gas power for home power safety, together with its key manufacturing sector.

One other notable instance is the case of the 2022 Australian Federal Elections following the unprecedented 2019-2020 bushfires and collection of extreme and widespread East Coast floods, the place long-standing conservative stronghold seats fell to ‘teal independents’ campaigning for higher local weather motion.

Consequently, its incumbent local weather laggard authorities was summarily changed by one other with extra formidable local weather targets, and, with it higher transition danger to entities that have been ill-prepared for such a sudden shift in local weather coverage.

With political commentators observing that the upcoming NZ election (on the time of writing) will characteristic local weather on the very prime of the agenda following the ravaging Auckland floods and ensuing Cyclone Gabrielle, it’s doubtless that this pattern of lived local weather catastrophe experiences will speed up transition pathways past clean trajectories in an rising variety of totally different jurisdictions.

So, what’s subsequent?

As a consequence of important uncertainty in local weather projections, limitations of present methodologies, and myopic view restricted to monetary impacts (our proverbial ‘crimson herring’), there’s a danger of being lulled right into a collective false sense of safety, leading to both poor coverage choices or deprioritising additional investigative makes an attempt. As a substitute, by advantage of is irreversible nature, and given what’s at finally at stake, it could as an alternative be prudent to protect in opposition to ‘dying by a thousand bites’ by the local weather piranha by contemplating the next:

- A clearer separation between local weather stress assessments and situation evaluation. Regulators ought to make workout routines extra prescriptive to allow comparability throughout monetary establishments – acknowledging that there’s nonetheless worth regardless of being measured by the identical flawed yardstick – however with organisations inspired to develop their very own inner view of danger;

- Broadening the sphere focus of local weather situations past strictly monetary outcomes – equivalent to consideration of revenues – with a purpose to not miss ‘early warning indicators’ of impending monetary stress and promote commensurate mitigative motion;

- Guaranteeing there’s illustration from varied disciplines (i.e., scientists, power and coverage consultants, enterprise consultants) past the established order of assuming that it lies inside the remit of stress testing or danger administration.

- Fostering a tradition of open debate amongst practitioners – local weather situation evaluation is much from settled science, particularly past tutorial circles, and contrarian opinions on either side needs to be additional contemplated upon fairly than discarded ab initio.

As local weather situation evaluation inside the broader business emerges as a self-discipline, it’s vital to make sure that it isn’t lowered right into a compliance pushed, ‘tick the field’ train with the intention of offering a single loss determine for danger administration to fixate upon, and assume will solely be related to tell capital concerns.

Relatively, local weather situation evaluation ought to contain actual creativity and an acceptance {that a} well-constructed evaluation ought to ask extra questions to assist steer strategic conversations concerning the monetary sector’s position in tackling local weather change.

Credit to Prof. Andy Pitman for helpful edits, and Insights Artist for assist with infographics. All opinions expressed are solely that of the authors.

This text was initially printed in UNSW Information and has been republished right here with the permission of the authors and the UNSW Information Staff. You can view the original article here.

This work is licensed beneath a Creative Commons Attribution-NonCommercial-No Derivatives CC BY-NC-ND Version 4.0.

CPD: Actuaries Institute Members can declare two CPD factors for each hour of studying articles on Actuaries Digital.